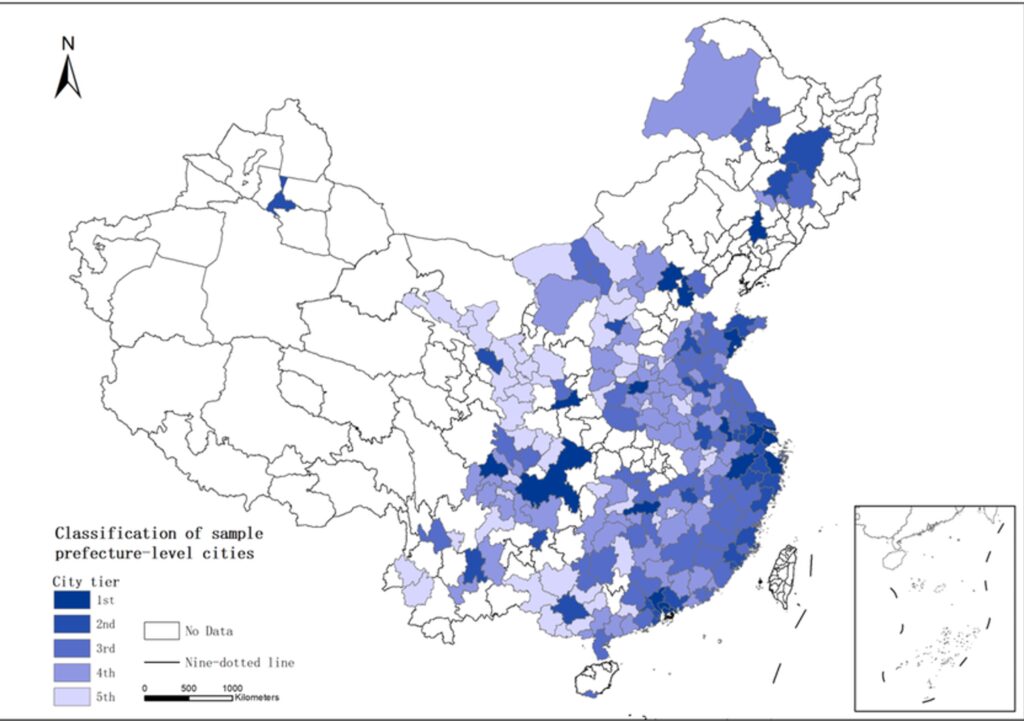

In May 2024 the China Daily newspaper published an article, announcing that 15 Chinese cities were named as ‘new Tier 1 cities’. These 15 new first-tier cities are Chengdu, Hangzhou, Chongqing, Suzhou, Wuhan, Xi’an, Nanjing, Changsha, Tianjin, Zhengzhou, Dongguan, Wuxi, Ningbo, Qingdao, and Hefei. According to the China Daily, the evaluation was based on five primary criteria: (1) concentration degree of commercial resources; (2) urban transport capacity; (3) vitality of urban population; (4) new economic competitiveness and (5) future potential. But what exactly is this tier system and why is it relevant for Belgian companies?

Source: ResearchGate

What is the city-tier classification system?

The Chinese city tier system (in Chinese: 中国城市等级制) is an unofficial hierarchical classification of Chinese cities. There are no official lists, as the Chinese government does not publish or recognize any official definition or a list of cities included in the tier system. The most common system of ranking China’s 613 cities is to categorize them into four respective tiers: Tier 1, 2, 3 or 4, usually based on GDP-level, the administrative and political status and the population size. Although there isn’t an official ranking, there is a general consensus that there are four Tier 1 cities which stand out from the rest: Shanghai, Beijing, Shenzhen and Guangzhou.

Taikooli shopping complex bustling with people in Chengdu, Sichuan province.

Half-rankings (such as ‘Tier 1.5 or 2.5’) have also become increasingly common, particularly in the real estate market. Most commonly, cities referred to as ‘Tier 1.5’ or ‘emerging first tier’ cities represent those that do not equal the traditional Tier 1 cities, but stand out beyond other traditional Tier 2 cities. Consequently, the above-mentioned ‘new Tier 1 cities’ could also be called Tier 1.5 cities.

Given the rapid development of Chinese cities, the tier system has gained wide popularity as a point of reference for purposes such as trade, transportation, tourism and education. Cities in different tiers often reflect differences in consumer behavior, income level, population size, consumer sophistication, infrastructure, talent pool, and business opportunity.

The famous Bund in Shanghai.

Why is this relevant for Belgian companies?

There are plenty of Belgian business people, tourists and students who have been to China, but many of them only travelled to Tier 1 cities and the traditional tourist hotspots. There are even plenty of foreigners who live and work in a Tier 1 city and almost never leave their bubble, believing that life in these Tier 1 cities is a benchmark for the rest of China. Obviously, the reality is quite different: although these cities are highly populated and the average GDP per capita is much higher than that of Tier 2 cities, Tier 1 cities only represent about 6% of China’s population.

A common mistake made by foreign businesses is to approach China as a single, unified market. In reality, the Chinese market is of enormous size, scale, and diversity. There are quite a lot of regional differences in terms of culture, food, geography and economic development. Consequently, the city-tier system offers foreign companies a practical tool to navigate the 613 cities that make up China.

How to use the Tier system for your China strategy

Traditionally, Tier 1 cities are the wealthiest, have the best-educated people and top infrastructure and offer the best quality of life. Therefore, Belgian companies targeting Chinese consumers may focus on those top Chinese cities. However, the cost of living and competition are also the highest in those cities. Consequently, it may be useful to consider looking at Tier 1.5, Tier 2 or even lower-Tier cities for your business development in China. In those lower and emerging tier cities you will also find an increasingly large affluent middle class, equivalent to some developed regions in Europe.

Belgian manufacturing companies or companies sourcing products from China may choose to consider locating in or sourcing from suppliers in lower-tier cities as well in order to benefit from lower operational and labor costs and cheaper land. However, business people and consumers in these areas tend to be more conservative, holding on to traditional values more than in Tier 1 cities. This may make it more challenging to start a business in those cities, but easier to build long-term relationships.

To conclude, China’s city-tier classification is a good reference point for businesses seeking a general overview of the Chinese market. It can help companies understand the consumer and market dynamics of a particular city, and is useful for businesses when making decisions about investment, expansion, and marketing. However, the system is by no means comprehensive and should not be used as the only criterion for your China strategy. You should also consider other criteria, such as local regulations, competitors’ activities, supply chain requirements, etc.

Please contact the Belgian-Chinese Chamber of Commerce (BCECC) in case you have any questions.