During a webinar hosted by the Belgian-Chinese Chamber of Commerce (BCECC) on 17 December 2024, the Sino-Benelux Business Survey was presented. This survey is conducted by the Benelux Chamber of Commerce in China (Bencham) for the 9th time, shedding light on the state of business for Belgian, Dutch and Luxembourg companies in China in the past year, including the economic performance, the main challenges and future expectations. Bencham published its findings in an extensive report, which is also accessible for BCECC members upon request.

After the opening remarks by Mr. Bernard Dewit, Chairman of the BCECC, and an introduction speech by Mr. Thomas Knoop, General Manager of Bencham East China, Mr. Brian Blömer, Partner and Head of Corporate Services of MSA Asia, presented the survey results. Despite the global economic turbulence, China’s economy is showing signs of recovery, with growth rates of around 5% in 2023 and 2024. These developments underscore the importance of China as a market for businesses worldwide.

Introduction

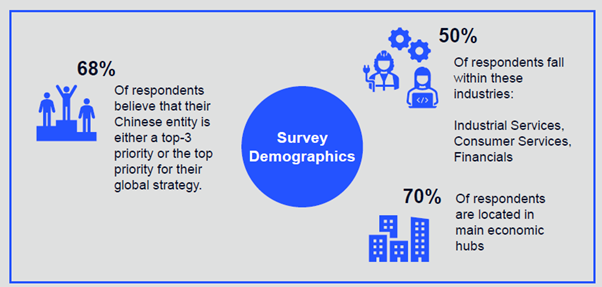

The 2024 Sino Benelux Business Survey was conducted between May and July 2024, gathering insights from a diverse group of Benelux companies operating in China. The majority of respondents were from the Netherlands (44.3%), Belgium (30.2%), and Luxembourg (3.8%), while a smaller portion has strong ties to management from the Benelux (21.7%). Most companies are situated in economically strong regions such as Beijing, Shanghai, and the Greater Bay Area.

The survey encompassed a wide range of companies from various industries and revenue sizes, with the majority falling under the classification of small and medium-sized enterprises (SMEs). It was found that the most significant strategic factor for Benelux companies operating in China is the domestic market size (significant for 57% of respondents), and for 68% of the respondents the Chinese operations are within the top 3 priority of the group’s global strategy.

Business performance

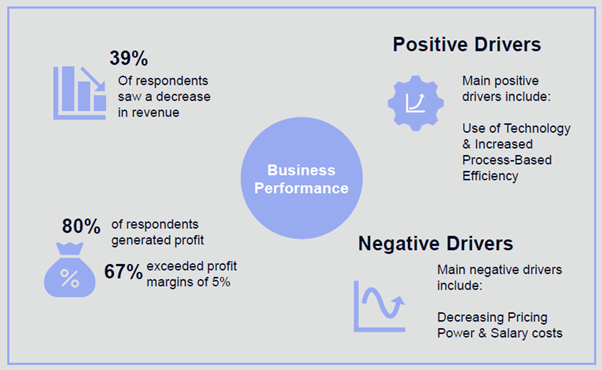

As was to be expected considering the developments in 2023, a growing number of respondents reported negative revenue growth: 39% of the respondents reported revenue shrinking and another 21% reported growth below 5%. At the same time, the number of respondents reporting significant revenue growth of over 20% shrank from 16% to 8%. Despite this strong negative shift, still 79% of companies reported profits, a decrease of 6% compared to last year’s survey. 67% of respondents even reported a profit margin over 5%, indicating the strong resilience of Benelux companies in China.

In terms of positive drivers, respondents highlighted the importance of use of technology, increased process based efficiency and innovation and R&D. On the other hand, decreasing pricing power emerged as the main significant negative driver, followed by salary costs and unlevelled playing field. Most notable is the decrease in significance of salary costs, ranked second after being the main negative driver for the first 5 years of the survey. Last year’s leading negative factor, material costs, saw a significant drop to fifth place. The new top negative driver is decreasing pricing power, which surged in significance.

Business sentiment

In 2023, Benelux companies operating in China exhibited a more balanced and cautiously optimistic perception of the market compared to the previous year. Unfavorable perceptions declined to 21% (from 27% in 2022), while somewhat unfavorable views also decreased, dropping to 18% from 30%. Neutral opinions saw a notable rise, increasing to 32% from 16%, and somewhat favorable views grew to 26% from 18%. However, the fully favorable category experienced a sharp decline, falling to 4% from 10% in 2022. These shifts suggest a more measured outlook, with companies moving away from both extremes and reflecting a cautious optimism. Despite the improvements, the marked decrease in fully favorable perceptions highlights persistent uncertainties about the Chinese market.

Onward expectations

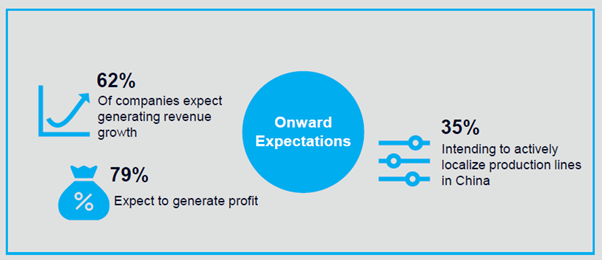

For the entire year 2024, at the time the survey was held in the first half of 2024, respondents had more pessimistic expectations for revenue growth and profit margins compared to previous years, along with a more cautious outlook for their prospects over the next five years.

In conclusion, Benelux companies in China faced a challenging 2023, with a notable rise in reports of declining revenue growth and reduced optimism for future profitability. Despite these setbacks, a significant majority still reported profits, underscoring the resilience of these businesses. Positive drivers, such as technology adoption and process-based efficiencies, helped offset some of the negative pressures. However, new challenges emerged, including decreased pricing power and persistent salary costs, reshaping companies’ priorities. Looking ahead, these firms adopt a more cautious outlook for the future, balancing optimism with an awareness of ongoing market uncertainties.

Please contact the Belgian-Chinese Chamber of Commerce (BCECC) in case you want to receive a copy of the report or in case you have any questions.