On the 31st of January 2024, the Belgian-Chinese Chamber of Commerce (BCECC) organized a webinar about China’s economic forecast for 2024, with notable speakers from KU Leuven University and the European Union Chamber of Commerce in China (EUCCC).

After the opening words by Mr. Bernard Dewit, Chairman of the BCECC, Ms. Dorien Emmers, Assistant Professor at the Chinese Studies Group and the Department of Economics of KU Leuven, gave an historical view on China’s economic development since the late seventies of the past century. Despite China’s impressive growth in the past 4 decades and the fact that 800 million people have been lifted out of poverty, inequality has increased sharply in China, mainly caused by the income inequality between rural and urban areas.

Today, China’s economy is in a transition phase. After a first phase of industrialisation and urbanisation, with a lot of investment opportunities and a great need for cheap workers, China entered a new phase of economic development: a more advanced, high-tech, innovation-driven economy. Consequently, China increasingly needs a highly educated workforce. At this moment, only approximately 15.5% of the Chinese labour force holds a university degree, which is much less than other middle-income or high-income countries. According to Ms. Emmers, in order to reduce the income inequality and keep a sustainable growth, China needs to invest more in human capital and focus on expanding its middle class.

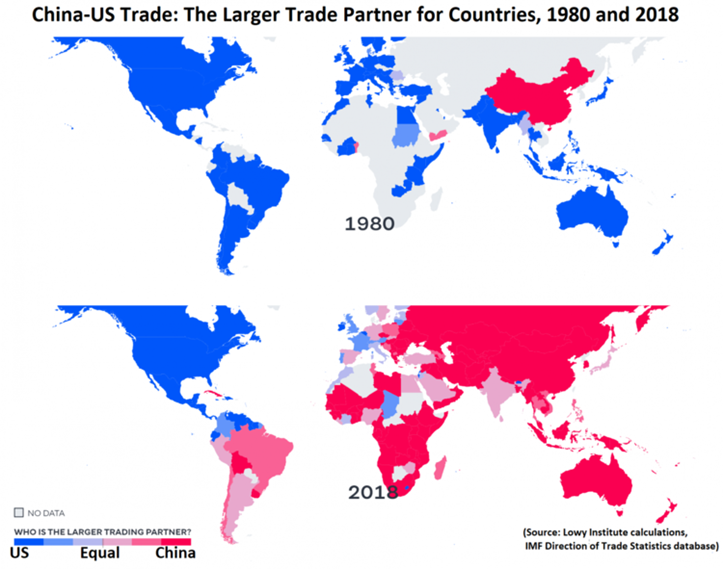

The year 2023 has been a rollercoaster of a year for China. After the re-opening of its borders, China’s economy bounced back in Q1 of 2023, but growth momentum is fragile and remains dependent on policy support. In 2023 China’s GDP grew by 5.2% and in 2024 a growth rate of 4.2% is expected. Today, China is already the 2nd biggest economy in the world, and the main trading partner for 128 countries globally, whereas the United States is the largest trading partner for only 62 countries.

The European Business in China Position Paper

The second part of the webinar was presented by Mr. Adam Dunnett, Secretary General of the European Union Chamber of Commerce in China, supported by Mr. Davide Cucino, European Chamber Overseas Representative in Brussels. At the end of 2023, the EUCCC published its European Business in China Position Paper, outlining how China’s post-COVID-19 recovery has faltered and how many European companies are questioning what kind of relationship China wants to have with them.

In the past years, overall confidence in China’s growth prospects have deteriorated. Many companies have pledged to making their supply chains more durable and have become increasingly risk averse. This included shifting investments out of China, or in contrast, onshoring supply chains into China, hence increasing the disconnection between China and the West.

The Chinese government has continuously stressed that it aims to encourage more foreign investment. However, while companies are waiting for this pledge to be followed by action, China’s push for technological self-reliance continues to restrict foreign enterprises’ market access. According to a survey by the EUCCC, if provided with greater market access, 65% of European companies in China would consider expanding their footprint in China.

In the position paper, the EUCCC has formulated 5 key recommendations to the Chinese government, aiming at restoring business confidence:

- Increase productivity by giving greater play to market forces.

- Reduce corporate risk by de-politicising the business environment and removing ambiguity in legislation.

- Optimise policymaking by allowing space for discussion and constructive feedback.

- Address socio-economic challenges to boost consumption.

- Maintain a balance between economic recovery and the low carbon transition.

The EUCCC also formulated recommendations to the European Union and to European companies. It is important to continue to proactively engage with China and enhance the overall coordination between member states and EU institutional stakeholders in order to foster a united European approach towards China. European companies should maintain strong communication between the company headquarters and China operations, to ensure that headquarters receive accurate, on-the-ground information in order to make informed investment and operational decisions.

China is open for business, especially for European companies.

In the current geopolitical climate, there are some considerations that may suggest potential advantages for EU companies compared to their US counterparts when doing business with China. Historically, the EU has maintained a more neutral stance in its relations with China and the EU tends to engage with China through a more multilateral approach.

Depending on the industry, European companies may find specific opportunities in sectors where there is a high demand for European products and services, such as automotive products, aviation, healthcare, renewable energy, luxury goods and machinery. After a few turbulent years, EU companies may face increased competition from Chinese counterparts.

Therefore, EU companies must carefully assess risks and opportunities associated with their engagement with China. A nuanced understanding of regulatory frameworks, geopolitical developments, and market dynamics is crucial for making informed business decisions. Additionally, companies may need to adopt agile strategies that allow them to adapt to evolving circumstances, fostering resilience in the face of geopolitical uncertainties.

Please contact the Belgian-Chinese Chamber of Commerce (BCECC) in case you need more information.